Loanable Funds Theory Of Interest

Loanable Funds Theory Of Interest. Liquidity preference theory of interest, monetary theory of interest. It recognises that money can play a disturbing role in the saving and investment processes and thereby causes variations in the level of income. Because a high interest rate makes borrowing more expensive, the quantity of loanable funds demanded falls as the interest rate rises. The rate of interest is price paid for using someone else's money for a specified time period. Loanable funds theory is different from keynes' theory in the following respects: Macroeconomics, which is the study of the economy as a whole rather than individual firms and households, considers it is the intersection of the supply and demand of loanable funds that sets the interest rate. Robertson, the loanable funds theory is a commonsense explanation of the determination of the rate of interest. In economics, the loanable funds doctrine is a theory of the market interest rate.

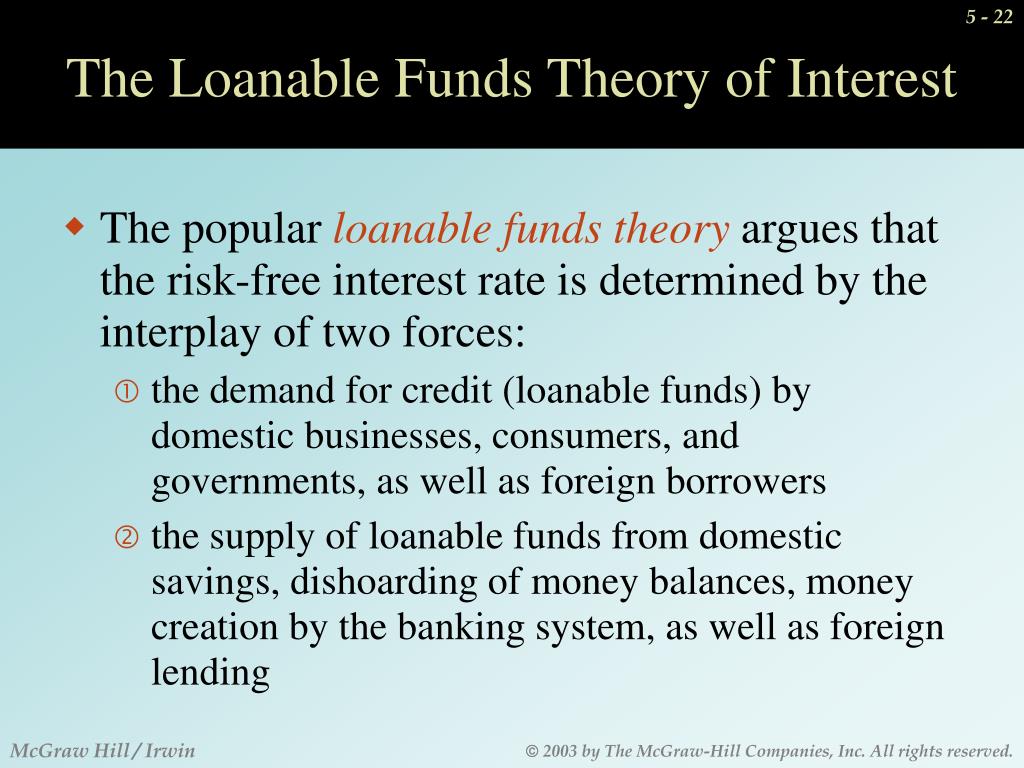

In economics, the loanable funds doctrine is a theory of the market interest rate. The equilibrium interest rate is determined in the loanable funds market. The term loanable funds includes all forms of credit, such as loans, bonds, or savings deposits. The loanable funds theory is in many regards nothing but an approach where the ruling rate of interest in society is — pure and simple — conceived as nothing else than the price of loans or credit, determined by supply and demand — as bertil ohlin put it — in the same way as the price of eggs. Lft) has met a paradoxical fate. The term loanable funds is used to describe funds that are available for borrowing. The loanable funds theory is an attempt to improve upon the classical theory of interest. Although the fundamental elements of this theory have been accepted by the mainstream monetary theory, few contemporary economists quote it explicitly.1 an important exception can be found in the text of woodford (2003). Suppose the market rate of interest were instead 10 percent.

The loanable funds theory (hereinafter:

The market for loanable funds. Along = quantity of loanable funds demanded shifts = loanable funds are demanded. Keynes considers money supply as a fixed factor. The supply for loanable funds (slf) curve slopes upward because the higher the real interest rate, the higher the return someone gets from loaning his or her money. Liquidity preference theory of interest, monetary theory of interest. The aggregate of all the individual financial markets. According to this approach, the interest rate is determined by the demand for and supply of loanable funds. That answer is the green interest rate shown in the diagram. The total amount of credit available in an economy can exceed private savings because the bank system is in a position to create credit out of thin air. The supply of loanable funds comes from savings by individuals, business concerns, discharging of idle cash. Thus, an investor's demand for loanable funds arises due to the productivity of the capital investment. The theory of loanable funds is based on the assumption that households supply funds for investment by abstaining from consumption and accumulating savings over time. The loanable funds theory (hereinafter: Classical theory of interest rate this theory was developed by economists like prof. Changes in the market for loanable funds.

They could increase, stay the same or decrease. The rate of interest is price paid for using someone else's money for a specified time period. The loanable funds doctrine extends the classical theory, which determined the interest rate solely by savings and investment, in that it adds bank credit. But this theory is also not free from the demand and supply schedules for loanable funds determine the equilibrium rate of interest or which does not equate each component on the. An increase in the rate of interest is, in essence, an increase in. Diagramatic illustration of loanable funds (the neo classical) theory of interest.

Robertson, the loanable funds theory is a commonsense explanation of the determination of the rate of interest.

Introduction to the loanable funds theory: In economics, the loanable funds doctrine is a theory of the market interest rate. The equilibrium interest rate is determined in the loanable funds market. The total amount of credit available in an economy can exceed private savings because the bank system is in a position to create credit out of thin air. But this theory is also not free from the demand and supply schedules for loanable funds determine the equilibrium rate of interest or which does not equate each component on the. Robertson, the loanable funds theory is a commonsense explanation of the determination of the rate of interest. Changes in the market for loanable funds. How interest rates change is not determined by excess saving: Although the fundamental elements of this theory have been accepted by the mainstream monetary theory, few contemporary economists quote it explicitly.1 an important exception can be found in the text of woodford (2003). The term loanable funds includes all forms of credit, such as loans, bonds, or savings deposits. The loanable funds doctrine extends the classical theory, which determined the interest rate solely by savings and investment, in that it adds bank credit. Because a high interest rate makes borrowing more expensive, the quantity of loanable funds demanded falls as the interest rate rises. That answer is the green interest rate shown in the diagram.

Macroeconomics, which is the study of the economy as a whole rather than individual firms and households, considers it is the intersection of the supply and demand of loanable funds that sets the interest rate. They could increase, stay the same or decrease. Finally, it will be argued that the identification of saving with the. In economics, the loanable funds doctrine is a theory of the market interest rate.

Suppose the market rate of interest were instead 10 percent.

The equilibrium interest rate is determined in the loanable funds market. In economics, the loanable funds doctrine is a theory of the market interest rate. Liquidity preference theory of interest, monetary theory of interest. According to keynes, the demand for an supply of money determine the rate of. Robertson, the loanable funds theory is a commonsense explanation of the determination of the rate of interest. They could increase, stay the same or decrease. Although the fundamental elements of this theory have been accepted by the mainstream monetary theory, few contemporary economists quote it explicitly.1 an important exception can be found in the text of woodford (2003). Finally, it will be argued that the identification of saving with the. The supply of loanable funds comes from savings by individuals, business concerns, discharging of idle cash. The supply of loanable funds has a positive (direct) relationship with. The market for loanable funds. It recognises that money can play a disturbing role in the saving and investment processes and thereby causes variations in the level of income. Loanable funds are supplied out of people's savings government budget surplus international borrowing of the three people's savings are the main source of the supply of loanable funds. Changes in the market for loanable funds.

Along = quantity of loanable funds demanded shifts = loanable funds are demanded loanable funds theory. Although the fundamental elements of this theory have been accepted by the mainstream monetary theory, few contemporary economists quote it explicitly.1 an important exception can be found in the text of woodford (2003).

Source: kokminglee.125mb.com

Source: kokminglee.125mb.com The loanable funds theory states that interest rates will be determined by the supply and demand for funds.

In a few words, this market is a simplified view of the financial system.

In economics, the loanable funds doctrine is a theory of the market interest rate.

Source: i1.rgstatic.net

Source: i1.rgstatic.net Loanable funds are supplied out of people's savings government budget surplus international borrowing of the three people's savings are the main source of the supply of loanable funds.

Source: www.economicsdiscussion.net

Source: www.economicsdiscussion.net If the blue (loanable funds equilibrium) interest rate is above the red (liquidity preference equilibrium) interest rate, then either desired investment exceeds desired saving, or the until the two different theories end up giving the same answer.

Source: i1.rgstatic.net

Source: i1.rgstatic.net Loanable funds are supplied out of people's savings government budget surplus international borrowing of the three people's savings are the main source of the supply of loanable funds.

Source: i.ytimg.com

Source: i.ytimg.com But loanable funds theory states that money supply is influenced by the rate of interest.

Source: slideplayer.com

Source: slideplayer.com Suppose the market rate of interest were instead 10 percent.

Source: slidetodoc.com

Source: slidetodoc.com Macroeconomics, which is the study of the economy as a whole rather than individual firms and households, considers it is the intersection of the supply and demand of loanable funds that sets the interest rate.

Source: slideplayer.com

Source: slideplayer.com Loanable funds are supplied out of people's savings government budget surplus international borrowing of the three people's savings are the main source of the supply of loanable funds.

Liquidity preference theory of interest, monetary theory of interest.

The loanable funds theory (hereinafter:

Source: i.ytimg.com

Source: i.ytimg.com It seems that the loanable funds theory suggests that all that is saved is supplied in the market for loanable funds.

Source: www.economicsdiscussion.net

Source: www.economicsdiscussion.net Keynes attacked the classical theory of the liquidity preference and loanable funds theories of the interest rate, on which controversy first flared during the later 1930s following the publication of.

Source: qph.fs.quoracdn.net

Source: qph.fs.quoracdn.net The total amount of credit available in an economy can exceed private savings because the bank system is in a position to create credit out of thin air.

Source: imgv2-2-f.scribdassets.com

Source: imgv2-2-f.scribdassets.com Macroeconomics, which is the study of the economy as a whole rather than individual firms and households, considers it is the intersection of the supply and demand of loanable funds that sets the interest rate.

Source: image.slidesharecdn.com

Source: image.slidesharecdn.com Introduction to the loanable funds theory:

The total amount of credit available in an economy can exceed private savings because the bank system is in a position to create credit out of thin air.

Source: i.ytimg.com

Source: i.ytimg.com It recognises that money can play a disturbing role in the saving and investment processes and thereby causes variations in the level of income.

Source: i.ytimg.com

Source: i.ytimg.com The supply of loanable funds comes from savings by individuals, business concerns, discharging of idle cash.

Loanable funds theory is different from keynes' theory in the following respects:

Source: slidetodoc.com

Source: slidetodoc.com According to keynes, the demand for an supply of money determine the rate of.

Source: kokminglee.125mb.com

Source: kokminglee.125mb.com They could increase, stay the same or decrease.

Source: image.slidesharecdn.com

Source: image.slidesharecdn.com Keynes considers money supply as a fixed factor.

Source: i.ytimg.com

Source: i.ytimg.com In economics, the loanable funds doctrine is a theory of the market interest rate.

Source: crimfi.files.wordpress.com

Source: crimfi.files.wordpress.com # of dollars that a borrower pays and a lender receives in interest in a year.

Source: i1.wp.com

Source: i1.wp.com The loanable funds theory states that interest rates will be determined by the supply and demand for funds.

Source: larspsyll.files.wordpress.com

Source: larspsyll.files.wordpress.com The equilibrium interest rate is determined in the loanable funds market.

Posting Komentar untuk "Loanable Funds Theory Of Interest"